MI member Argus provides its most recent global methanol industry demand/forecast, production demand/forecast, and methanol unit operating schedule. Argus delivers a comprehensive view on global methanol markets, from upstream natural gas, coal, and other feedstocks to the downstream end user. They provide contract and spot prices, global industry news, analysis of key market drivers, price forecasts, supply and demand outlooks, and consulting.

The Methanol Institute is sharing the information provided by Argus as a service to the community. This does not represent an endorsement by MI and we assume no liability whatsoever concerning the accuracy and completeness of the information presented below and disclaim all liability arising out of the use of such data.

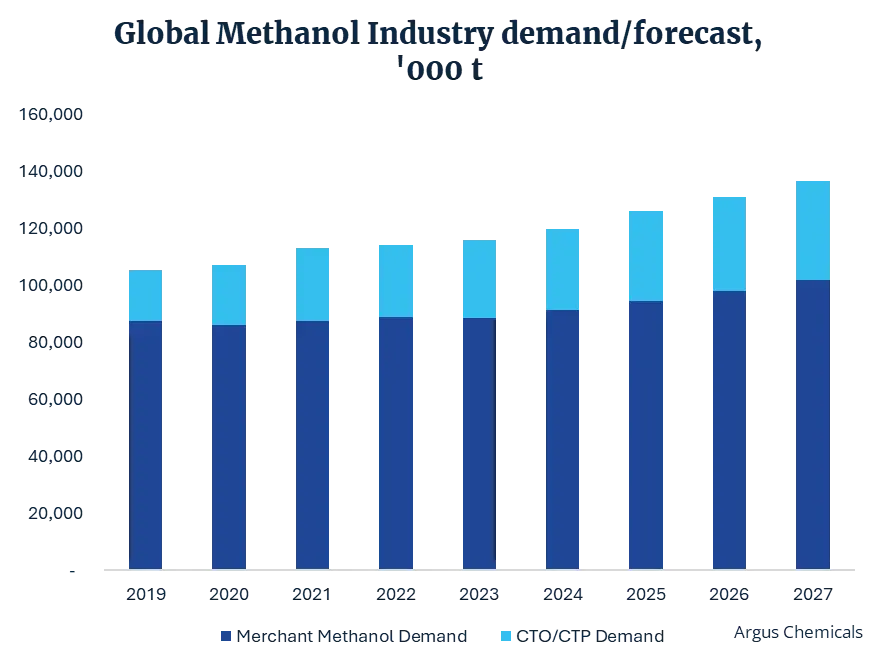

Global methanol demand remained mostly flat from 2020 to 2023, weighed down by the COVID-19 pandemic, the Russia-Ukraine conflict, and broader economic challenges like inflation and recession fears.

In 2024, however, demand began to recover, growing by 2–3% compared to the average of the previous four years. This upward trend reflects a gradual rebound in global economic activity.

Looking ahead, slightly improved, but still cautious, GDP forecasts are expected to support continued growth in methanol demand, particularly through downstream uses in the chemical sector.

In China, methanol-to-olefins (MTO) production is projected to pick up this year. However, this growth faces headwinds from ongoing economic uncertainty and weak prices for olefins and their derivatives.

While current forecasts anticipate methanol demand to grow by as much as 3 million tonnes over 2024 levels, this estimate may be revised downward if market conditions do not improve in the coming months.

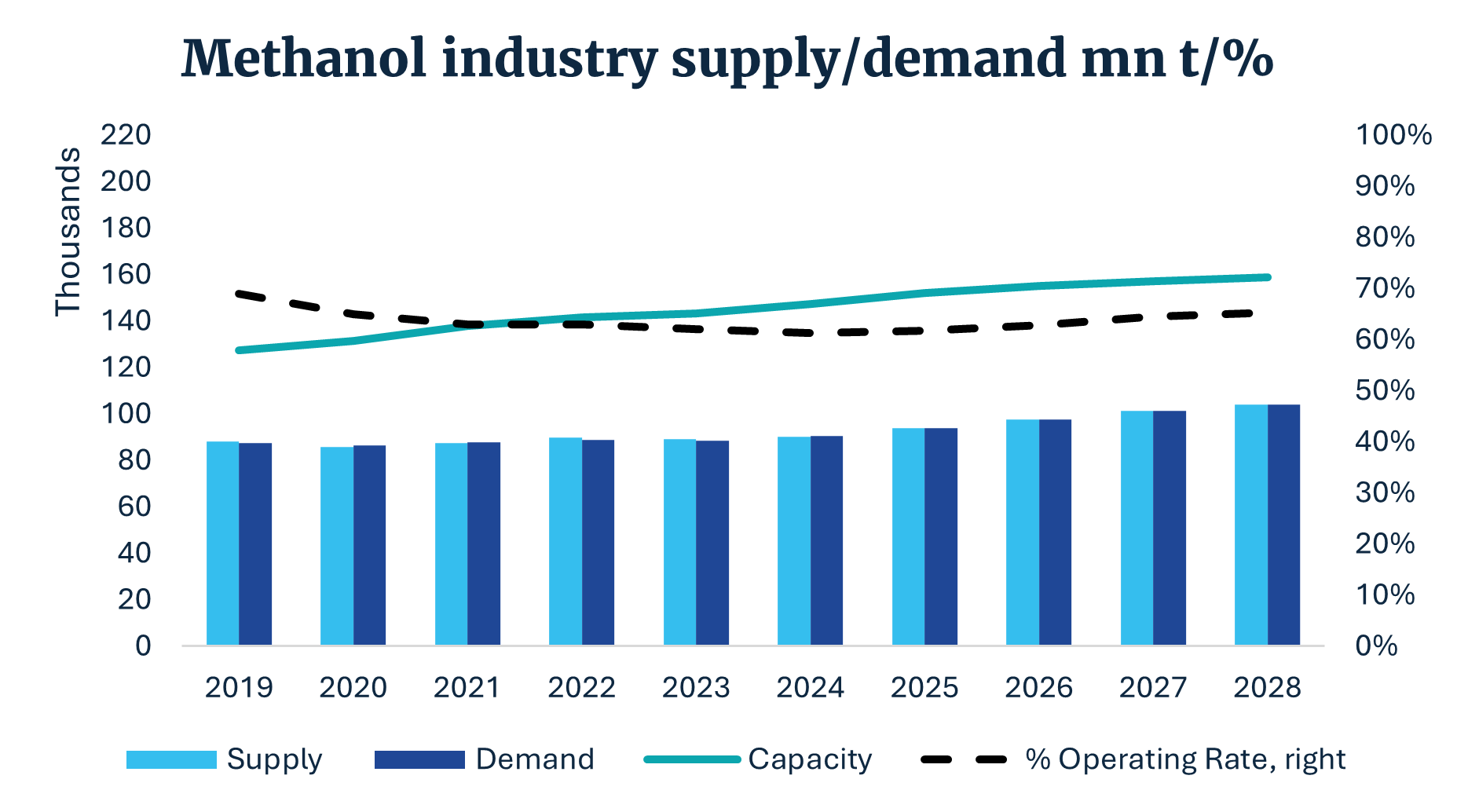

In a balanced market, global methanol production typically keeps pace with demand. For the first time in decades, however, forecasted demand is set to grow slightly faster than industry capacity.

Despite this shift, the industry is still well-positioned to meet future demand. Most of the additional capacity—either already online or expected by 2025—is coming from North America, Southeast Asia, the Middle East, and China.

As demand gradually overtakes the pace of new supply additions, global operating rates are expected to improve, signaling a healthier, more efficient market environment.

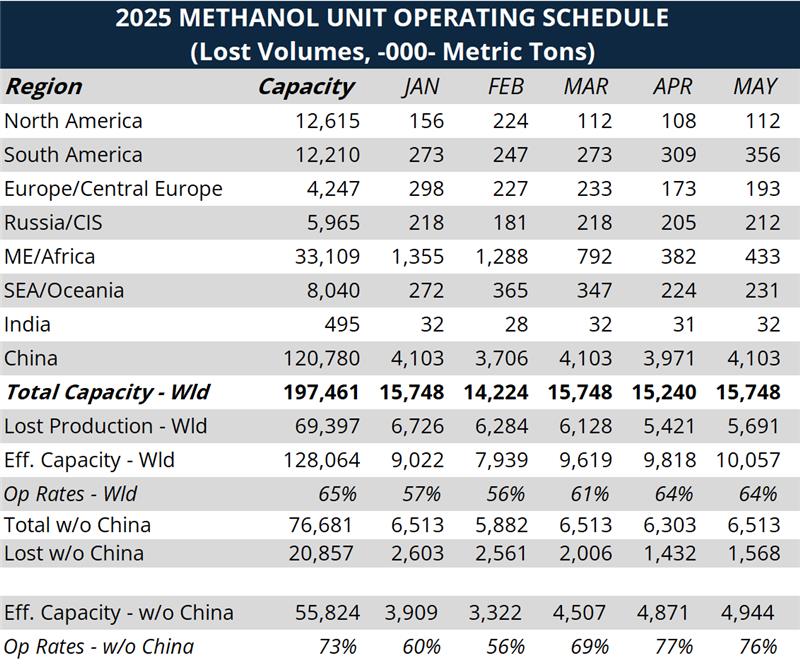

The global methanol market continues to face both planned and unplanned outages. Natgasoline and Equinor’s European unit are gradually resuming operations, while Iranian methanol plants are coming back online after a winter that redirected natural gas supplies. Venezuela and Germany are also seeing a slow recovery in methanol production.

Meanwhile, Sarawak Methanol in Malaysia, which began operations in December 2024, has entered an extended downtime expected to last through March. In Equatorial Guinea, methanol production—primarily supplying Europe—remains offline with no estimated restart date.